- Quicken mint mycardstatement how to#

- Quicken mint mycardstatement for android#

- Quicken mint mycardstatement software#

- Quicken mint mycardstatement free#

So, who is the winner when it comes to Mint vs. Personal Capital monetizes its service by offering paid financial advisory services, which allows the application to run ad-free. Mint generates revenue by selling banner ads and recommending service slots on its website and applications. Personal Capital is the monetization of advertisements. On the other hand, Mint provides users with credit report monitoring, along with an optional paid credit reporting service.Īnother important factor when evaluating Mint vs. However, Personal Capital also offers investment monitoring.īecause of this, many users find that Personal Capital is a more comprehensive financial tool.

Personal Capital and Mint both have financial dashboards with the monitoring of budgets, expenses, and savings. Mint, one of the primary considerations is the different features each platform delivers. MintĪlthough Mint has long been one of the most popular financial tools, it is not necessarily the best choice for individuals who are truly looking to get a handle on their finances. YNAB is a paid service that has one flat monthly rate.

Quicken mint mycardstatement free#

Users can also receive financial advice and tools through free video workshops with financial experts. YNAB syncs with accounts and displays goals and progress in a variety of iterations.

Quicken mint mycardstatement software#

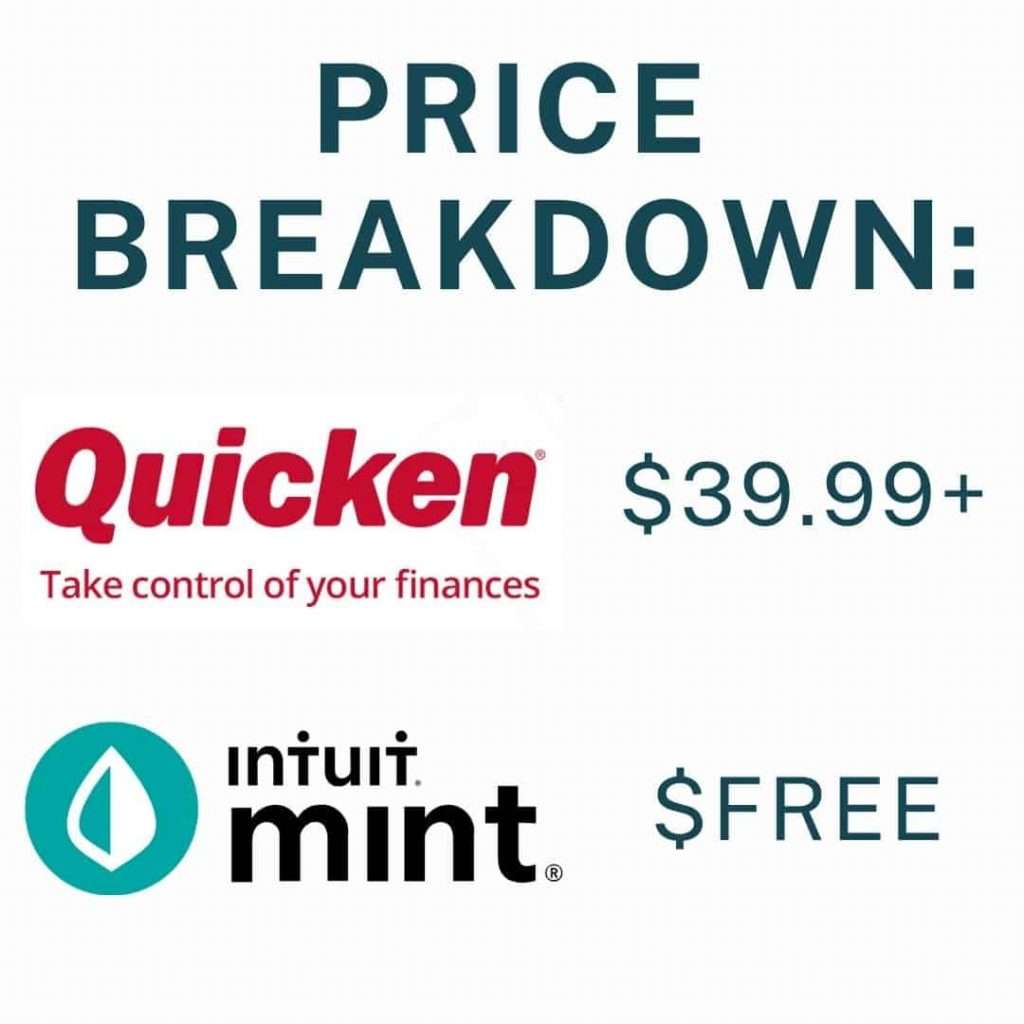

The software features a number of billing, payment, and planning tools that encourage financial stability and help users eliminate their debt. It encourages users to focus on intentionality when it comes to their finances. You Need a Budget (YNAB) is another commonly used tool for people looking for Mint alternatives. The basic product has budgeting, bill management, and account integration, while the premier product offers free bill payment and tax and investment management, among other services. There are different products available, and each comes with different features. This software also provides users with an array of financial tools in one simple dashboard, but it differs from both Mint and Personal Capital in that users must pay for a subscription to the software. Those who are looking for alternatives to Mint often turn to Quicken.

Quicken mint mycardstatement for android#

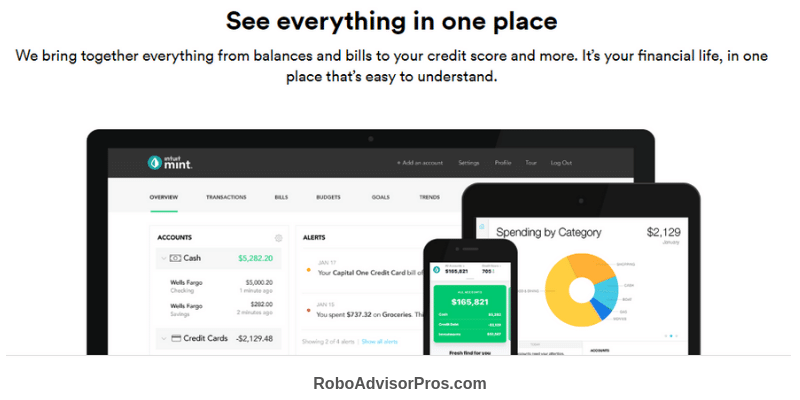

You can view your Mint financial dashboard on your desktop or on your phone or tablet with a mobile app that’s available for Android and Apple devices. It also provides daily credit monitoring so that users can keep track of any changes to their scores. However, Mint also offers free credit score monitoring, allowing users to get their credit reports quickly. Some of its features, including bill tracking, budgeting, and investment tracking, are similar to those found with Personal Capital. Mint is an all-in-one money management tool. Personal Capital also links to investment portfolios and retirement savings accounts to help users stay on track with their long-term financial goals.Īs part of its service, Personal Capital enables users to communicate with financial experts who can offer advice about their investments and help optimize their finances. The software tracks and categorizes spending to give users a clear picture of their net worth and financial standing. It’s a free service that allows users to link all their financial accounts and manage their debts and assets from a single dashboard. Personal Capital provides financial management services to more than 1.6 million users. Let’s get started with an overview of each. But what types of features do these different accounting software options have, and how do they stack up against one other?īelow we provide you with the ultimate guide comparing these financial tools, including Personal Capital vs. Some of the most popular programs are Personal Capital, Mint, Quicken, and You Need a Budget (YNAB). If you’ve decided to start using accounting software to track your expenses, create a budget, manage investments, and improve your overall financial situation, you may have already done some research into the different options available.

Quicken mint mycardstatement how to#

Miss him, don’t ya? Accounting for our profit and losses will give us a much clearer picture of our financial health and will help inform our decisions on how to improve our financial situation. Why are budgets and accounting so important? Well, I’ll let former President Bush explain it, Budgeting and accounting might not be the sexiest thing to talk about in fact, a Listen Money Matters survey found that 0% of successful relationships began with a conversation about accounting software.īut, these tools are undeniably essential to our financial health.

0 kommentar(er)

0 kommentar(er)